According to Statista, the 2021 CRM market revenue share in the U.S. was as follows:

| Vendor | Market Share (%) |

|---|---|

| Salesforce | 23.8 |

| SAP | 5.1 |

| Microsoft | 5 |

| Oracle | 4.9 |

| Adobe | 4.8 |

| SugarCRM | 2 |

| HubSpot | 1.8 |

| Zoho CRM | 1.7 |

| Insightly | 1.6 |

The top four vendors match the results of a survey we conducted in 2013.

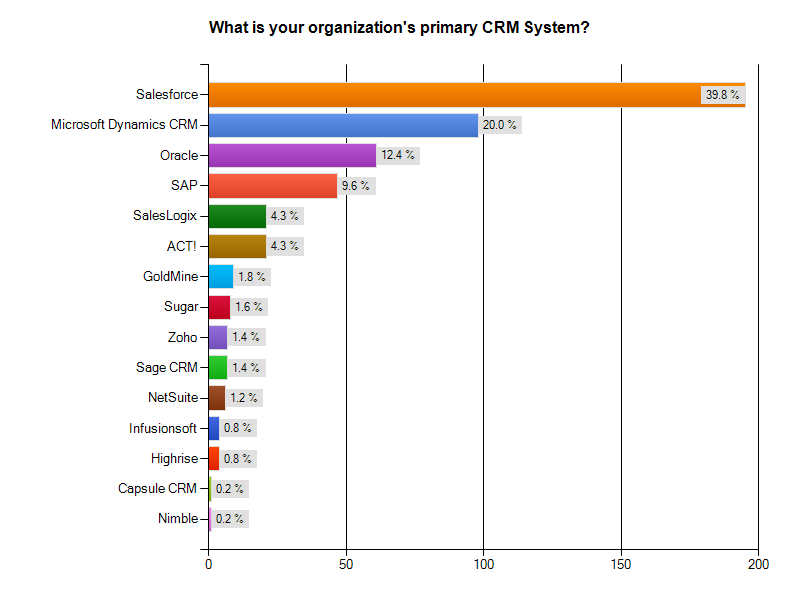

The survey results are below. The results were from the question — “What is your organization’s primary CRM system?” — rather than being based on revenue numbers.

A Quick Comparison

Salesforce has continued its market dominance.

SalesLogix, acquired by Infor in 2014, does not appear in the 2021 data. Nor do ACT! or GoldMine. Combined, these three accounted for over 10%.

The numbers for SugarCRM and Zoho have been flat.

HubSpot did not have a CRM offering when we ran our survey.

The rest of this post is the original data and content from 2013.

The Original Survey Data

In 2013, CRM Switch surveyed 752 employees from different U.S.-based companies to determine the relative market share of each popular CRM system. The overall survey results had a margin of error of ±3.6%.

Survey responses were collected the week of April 22, 2013. We also asked respondents to identify which of three categories of full-time employee count their company fell into.

The job categories of those surveyed included sales, marketing, and project management.

2013 CRM Market Share Leaders

The main question we asked in the survey was, “What is your organization’s primary CRM system?”

Respondents were presented with a list of popular CRM systems from which to choose. Respondents could also select a choice of “Other” and provide specifics. Almost 35% of those surveyed responded with “Other.” Of the 490 respondents who identified one of the listed CRM systems as their company’s primary CRM system, the following was the distribution across all sizes of company:

Some of the detail provided by respondents under the Other selection included:

• their organization has a custom-built CRM system

• their organization does not have a CRM system

• they did not know, by name, what their organization uses for CRM

• employees use Microsoft Outlook as their “CRM system”

• their organization uses a fundraising system, a professional services automation system, or some other point solution as their CRM system

• their organization uses an industry-vertical CRM system

U.S. CRM Market Share by Company Size

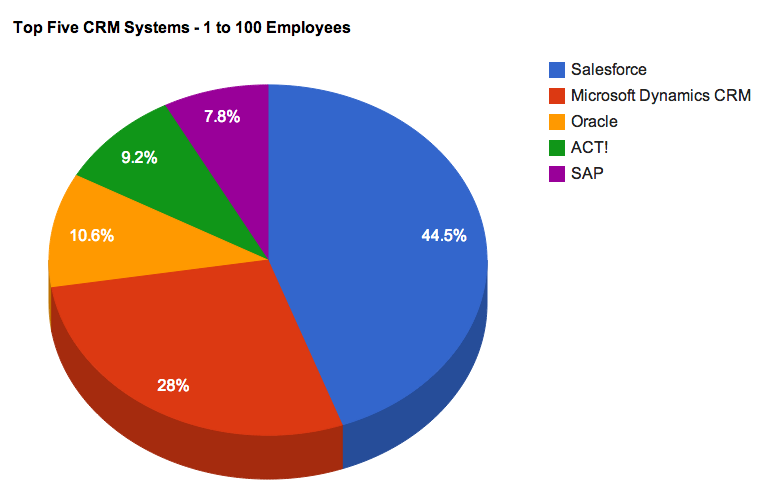

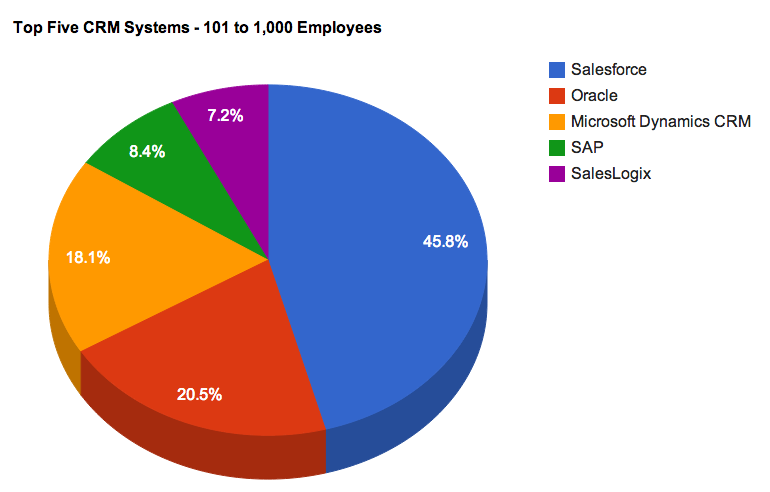

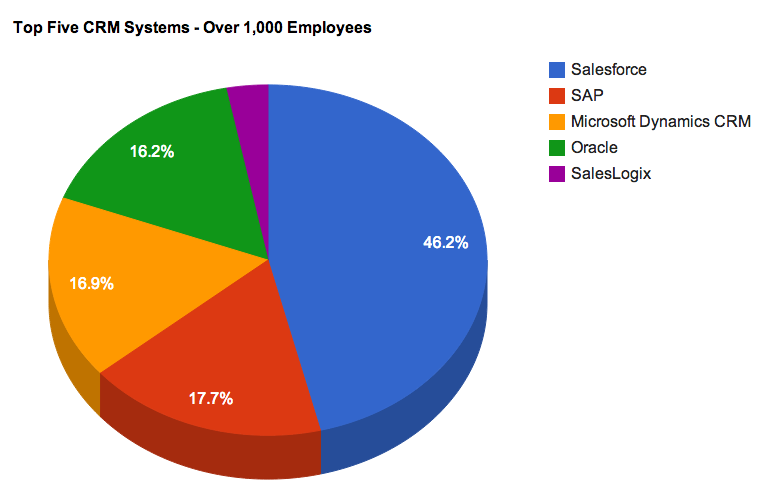

In each of three employee count ranges, we compared the top five responses for the range. The percentages shown are relative to the other four systems in the top five for each range.

1 – 100 Employees

101 – 1,000 Employees

Over 1,000 Employees

CRM Market Share by U.S. Census Region

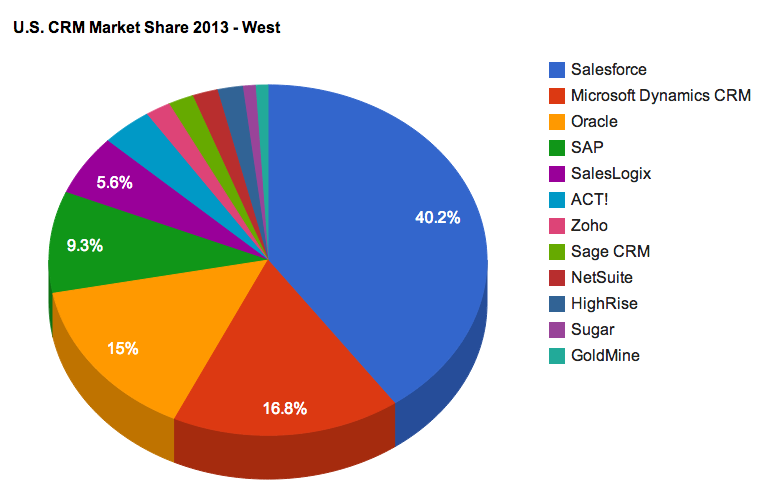

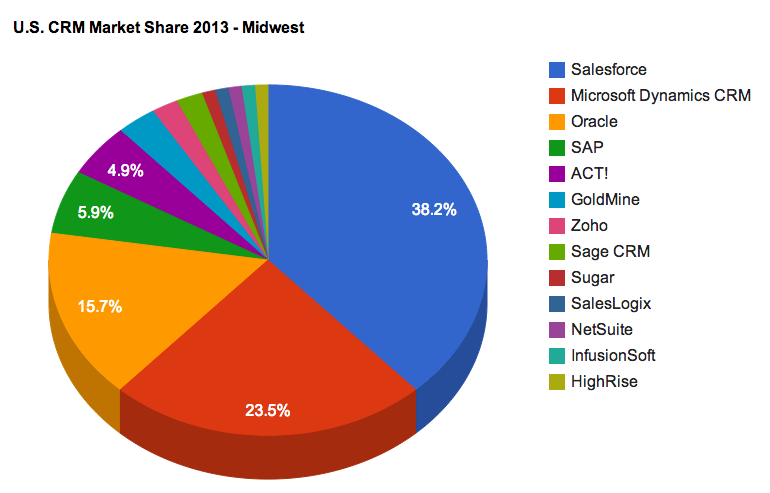

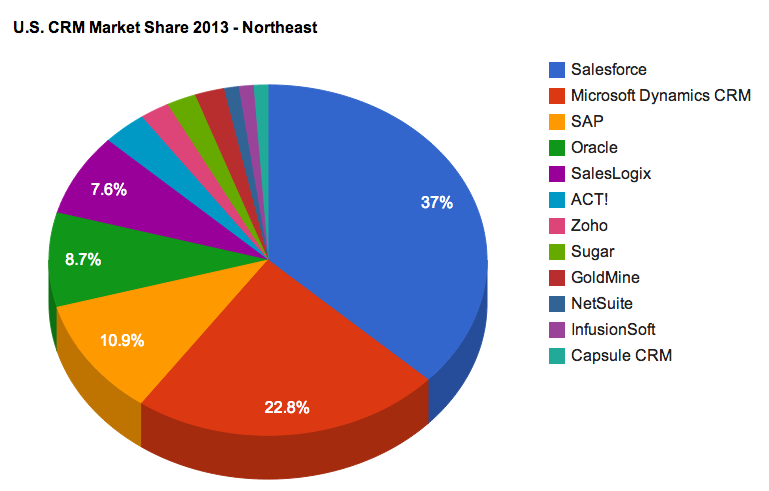

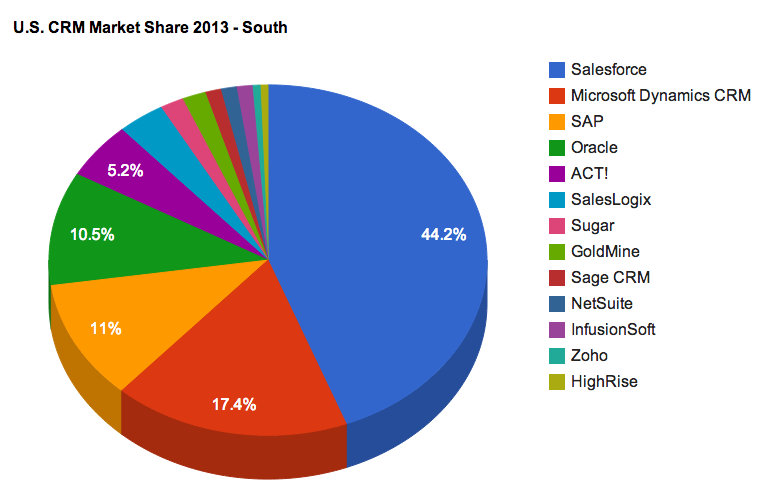

The following charts show the CRM market share for all listed CRM systems, segmented by the U.S. census region.

West

Midwest

Northeast

South

Overall CRM Survey Observations

Salesforce continues its market dominance across organizations of all sizes. It also has a remarkably consistent CRM market share across different-sized organizations compared to the four leading systems in each employee count category.

While salesforce.com only recently became the #1 CRM vendor globally, based on the data, it has had that #1 position well in hand in the U.S. for some time.

Salesforce has a more significant market share in the West and the South compared to the Midwest and the Northeast.

While Microsoft Dynamics CRM is #2 in overall CRM market share, its most significant relative share is in organizations with 100 or fewer employees. Microsoft CRM stacks up better against Salesforce in the Midwest and the Northeast than in the West and the South.

At CRM Switch, we have rarely seen Oracle and SAP considered as standalone systems by CRM buyers, so the relatively high market share of these two solutions is likely tied to the inclusion of CRM in the interdepartmental software offerings from these vendors.

Veteran applications SalesLogix and ACT!, acquired from Sage by SwiftPage, are in positions five and six. Collectively, SwiftPage has an approximately 8.6% market share among the listed CRM systems.

SalesLogix has its most significant relative market share in organizations that have between 101 and 1,000 employees. ACT! has its greatest relative market share in organizations with 100 or fewer employees.

Even though, at CRM Switch, we have witnessed a high market awareness of SugarCRM, and even though SugarCRM is generally regarded as being a mature, feature-rich application, only eight of the 490 people who selected one of the listed CRM systems identified Sugar as their company’s primary CRM system.

This suggests that SugarCRM has an opportunity to improve on execution with respect to new customer acquisition and/or customer retention.

While it’s still early for Nimble, they can parlay their strong, early marketing efforts into more new customers.